How to prevent HIPAA violations with this new way to file EOBs

Do you know how to prevent HIPAA violations when it comes to handling your EOBs? Many dental teams struggle to understand the best way to handle EOBs, and might not even realize the problems that the most common filing systems can cause. Let’s help you save time, money, and compliance problems when scanning and organizing your EOBs.

As a dental billing partner, we not only help increase your insurance revenues and improve your insurance billing system. We also help you keep your claims process clear, accurate, and compliant. There IS a correct way to file or scan your EOBs.

In this article, we will explain why it’s a mistake to follow the widespread practice of filing EOBs with patient charts.

We’ll also walk you through a faster way to and organize your EOBs that saves time, money, and helps you avoid HIPAA violations. You will walk away from this article with a solid newfound understanding of EOB organization and know the best practices for efficient recordkeeping.

Let’s get into it.

What are EOBs?

You probably know that EOB stands for explanation of benefits. What many don’t know is that it’s a financial statement. Even though it lists procedure codes, it’s a financial document because it explains payments, not treatments.

The EOB's purpose is to summarize insurance claim payments, downgrades, or denials for the date of service the treatment was provided.

It provides a quick overview of the procedures listed on the claim including the dentist’s submitted charges, and the amount paid to the dentist, and sometimes lists the amount the policyholder owes the dentist.

The EOB also explains why or how the insurance company determined the coverage for the patient’s procedure.

An EOB will typically include the following information:

- Procedure code billed

- Dollar amount charged

- The allowed/considered fee

- Deductible applied (or not)

- % covered

- Insurance payment

EOBS may also help explain payments with remarks such as:

- Insurance maximum met

- Deductible applied

- Additional information requested from the patient

- Additional information requested from the provider

- Denied procedures including details about how to appeal

Because EOBs are financial records, not clinical records, they need to be kept according to federal and state regulations for financial records. Of course, you want easy access for an audit, to answer patient questions, to look up information about adjustments, charges, payments, and denials, or to follow up on missing information and file appeals.

Medical records have their own rules for recordkeeping. Mixing financial and medical records can create a compliance nightmare for your office.

Common mistakes dental teams make when filing EOBs

As a dental billing company, we rely on EOBs just like any dental team. We have noticed these common filing habits that will cause compliance problems:

Mistake 1: Scanning the EOB into the practice management software during bulk insurance payment posting is a common mistake we see. In other words, when finalizing bulk insurance payments, scanning them directly into the document center with patient records is a mistake. This is because the bulk EOBs become visible in other patients' financial records.

To remain HIPAA compliant, you would need to separate and/or redact the EOBs and then scan them one by one into each of the patients’ records that were included in the bulk EOB.

This method of scanning them in one by one AND having to redact information is a waste of valuable time!

Mistake 2: Sometimes people file printed EOBs by date posted or even in patients’ charts because it makes it easy to look up by patient name or date. However, because the EOB lists dental codes for several patients, you’ve set yourself up for a breach of privacy. If someone has to access a patient’s records for any reason, this system risks violating the privacy of individuals who are not the patient. Filing by date posted is simple, but then you have storage issues with all of the paper EOBs.

Mistake 3: Managing EOBs like medical records. This may happen due to confusion about what type of record an EOB is. It’s a financial record, not a medical record, as explained above. So for simpler, seamless file management, it’s important – and wise – to keep your records organized separately by type.

Avoid these mistakes by following the steps our experts follow.

Best practice: Scan EOBs by the date the insurance payment was posted

Through many years as a dental billing company, we’ve found the most efficient way to scan and organize the EOBs is in their own file system, by the date the insurance payment was posted. Let’s explore this method below.

We recommend handling your EOBs the following way:

1. Choose a good scanner - but not just any scanner! You will want a scanner that will scan the front and the back of the EOB (some of the newer scanners will skip the blank back side of the EOB if there is nothing there) and let you load multiple pages (not one by one). There are many scanners on the market, please consult your IT provider or Software support for recommendations.

Organize your EOBs by insurance company in alphabetical order, for example, Aetna through United.

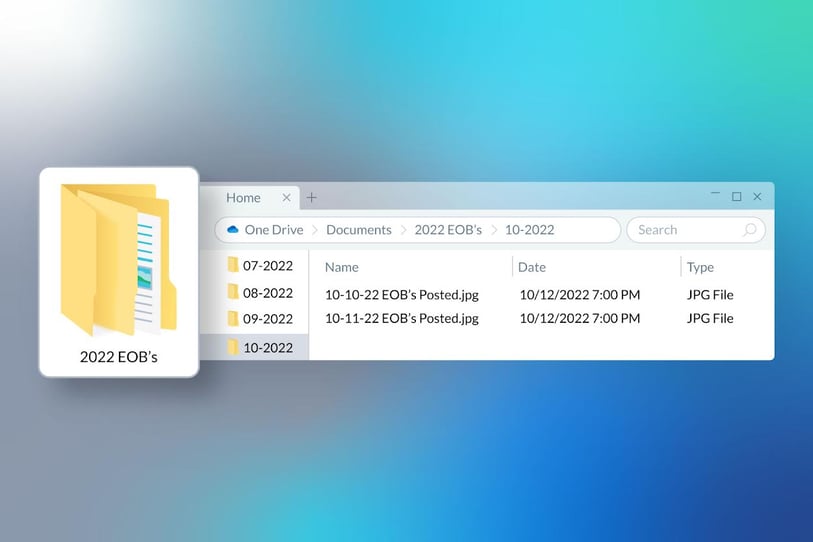

2. Scan EOBs into a folder named for the day the EOBs were posted (example below).

3. Name folders in a consistent way for your scanned EOBs. We recommend setting up folders by month and year (10-2022 for example), and the EOB files by month-day-year (10-12-22 EOBs posted.jpg for instance). See the following example:

a. Create a folder for the YEAR. Inside that folder, create 12 folders – one for each month (01-2022, 02-2022, etc).

b. Inside each monthly folder, file the batch of scanned EOBs. Name the file according to the date posted. See the example below:

Ask your IT team to create a shortcut on the desktop for all team members that may need access to the EOBs.

Make sure the folder is on your network shared drive in a protected and backed-up folder. Do NOT store them on a local computer C: drive as these are rarely backed up and not shared with other workstations. If you are not sure how to create a secure folder on your shared network, please contact your network administrator or IT provider.

How do you find an EOB for a patient?

Let’s say a patient asks for their EOB. You’ve filed them by date posted - so what’s the best way to locate it?

- Pull up your patient’s account on your practice management software and see when their EOB payment was posted. For example, say the payment was posted on October 12, 2022.

- Go into your EOB shared drive and open the folder for that month and year. For our example, you’ll open folder 10-2022.

- You’ll see a list of files labeled for the month and day the EOBs were posted. When you open the image file for the day you’ve looked up, (10-12-22-EOBs-posted.jpg in our example), you’ll find each EOB posted that day, in alphabetical order by insurance company. If the patient has United Healthcare, for instance, you will scroll closer to the bottom of the list of EOBs.

- Locate the patient’s name with the correct insurance company. (Yes, it’s that simple).

When you work with Dental ClaimSupport, you will always have a clear and concise understanding of the patient’s portion by looking at the insurance payment note created by your account executive when posting the insurance payment.

With good notes from your biller, you’d rarely need to look at the EOB unless a secondary claim was filed, since you will know what the insurance paid, what the write-off was, and the patient's amount due.

This best practice for filing EOBs not only avoids compliance issues. It saves you time and money.

- You stop paying for the time it takes to scan EOBs individually into patient charts

- You eliminate the need to check every file to redact information to protect privacy

- You avoid risking HIPAA penalty fines, which can hurt your finances and reputation

Check out this video for a walk-through of how to file your EOBs:

Ready to streamline your billing system and improve HIPAA compliance by working with a trusted dental billing partner?

Managing an efficient and compliant billing system is an important part of your role in your dental practice. The benefits of using best practices for filing EOBs are huge and protect your team and your patients.

When you work with Dental ClaimSupport, we will help you update this process of filing EOBs because it’s more efficient, and prevents HIPAA violations. This way, your team can spend their time delivering an excellent dental experience for your patients.

You can be confident that your billing isn’t draining time and money from the practice. Instead, you’ve got a clear, accurate, and compliant process you can be proud to manage.

We’re ready to help you lower costs, and benefit from more income! To learn more about working with Dental ClaimSupport, schedule a call with one of our billing experts.

Related Posts

Dental revenue resources from Dental Claim Support