Dental Billing | Dentrix Aging Report | Eaglesoft Aging Report | Dental Insurance Aging Report | Insurance Aging Report | OpenDental Aging Report

How to run an outsanding dental insurance aging report

Whether you’re new to the field of dentistry or trying to maneuver a new software for your practice, understanding the insurance aging report meaning, and how to process this report is a must! Knowing how to run the report and understanding the information on the report is vital for the health of your practice.

As an RCM service company, DCS runs these reports routinely in various software programs. We act as an extension of our dental practice team and educate them on these reports as well. This article will outline the importance of running an insurance aging report, what’s included in the report, and a step-by-step process on how to generate the report in Dentrix, OpenDental, and Eaglesoft dental practice management software.

Let’s answer some questions that are asked frequently about outstanding dental insurance aging reports before we walk you through how to run them.

First off, what is an outstanding dental insurance aging report?

A dental insurance aging report keeps track of all claims submitted to the insurance company that hasn’t been paid or received in your practice management software.

Simply put, all of your insurance claims submitted that have not been paid.

This report also shows the number of outstanding insurance claims, how long they have been outstanding, and the total dollar amount associated with the claims. Understanding this report will also allow you to determine how often you need to follow up.

Until the entire claim is paid or denied, a claim will stay on this report.

How does a claim get on my outstanding dental insurance aging report?

When a patient with dental insurance visits your practice, a dental claim is created and will be “batched” at the checkout by your team. The term “batched claim” is often used to describe the generation of the claim. The claim is a statement of services performed, the date services are provided, and itemized costs of those services.

The batched claim is then sent to the insurance company from your software. The claim can be sent to the insurance company in a couple of different ways. The most preferred route for providers and payers is to send the claim electronically through a clearinghouse. However, it can be physically mailed or faxed directly from the practice to the insurance company too.

How you send a claim will directly impact the rate at which the claim is processed. Think of it as an email correspondence versus a handwritten letter. The email will arrive almost instantaneously, whereas the letter will take much longer to be delivered. To keep a well-maintained insurance aging report, you want the fastest route of transmission for your claims, which is to submit them electronically through a clearinghouse.

Once the claim is sent, it is now part of your insurance aging report. Initially, it is housed in the 0-30 day category. As the days pass, the claim will age accordingly. For example, if 15 days have passed since a patient’s visit, the claim has aged 15 days. Insurance Aging Reports categorize aged claims into the following categories: 0-29, 30-59, 60-89, and 90+.

Most claims take anywhere from 7-14 days to process before your office will receive payment. There is a fine line between when you should follow up and when you should allow an insurance company the appropriate amount of time to process the claim.

You do not want to spend your time researching the status of a claim if the insurance company has not had enough time to receive and process it yet.

As a company that works on outstanding insurance aging reports on a daily basis, we can confidently say that allowing a full 30 days for the claim to process and pay is the most appropriate time range to begin researching.

What is the importance of my outstanding dental insurance aging report?

Insurance aging reports are important to run routinely as they provide a snapshot of outstanding insurance funds owed to the practice.

The older the claim, the harder it can be to receive reimbursement from the insurance company.

Ideally, you’d like to keep any claim from hitting the 90+ category. The reason being, most insurance plans include timely filing limits.

Timely filing occurs when a practice submits a claim or requested claim information and it has not been received by the insurance company within a set amount of time. Most allow 365 days from the date of service, but some plans have very short time frames of 60-90 days. When this happens, the insurance company is no longer responsible for the claim. Regardless of network status, the provider filing the claim has a responsibility to follow up with all claims to make sure it was filed correctly and any missing information is submitted. Patients are not happy if they receive a bill for services that would have been paid had the dental practice team submitted it correctly and followed up on the status of the claim.

Timely filing also takes the responsibility off the patient and puts it completely on the practice, when in-network. Although these can be disputed, it is best to avoid timely filing as they can become financially costly to your practice.

How do I run the outstanding insurance aging report in Dentrix, OpenDental, and Eaglesoft?

Below you will find a step-by-step guide on how to run the outstanding insurance aging report for the 3 most popular dental practice management software on the market.

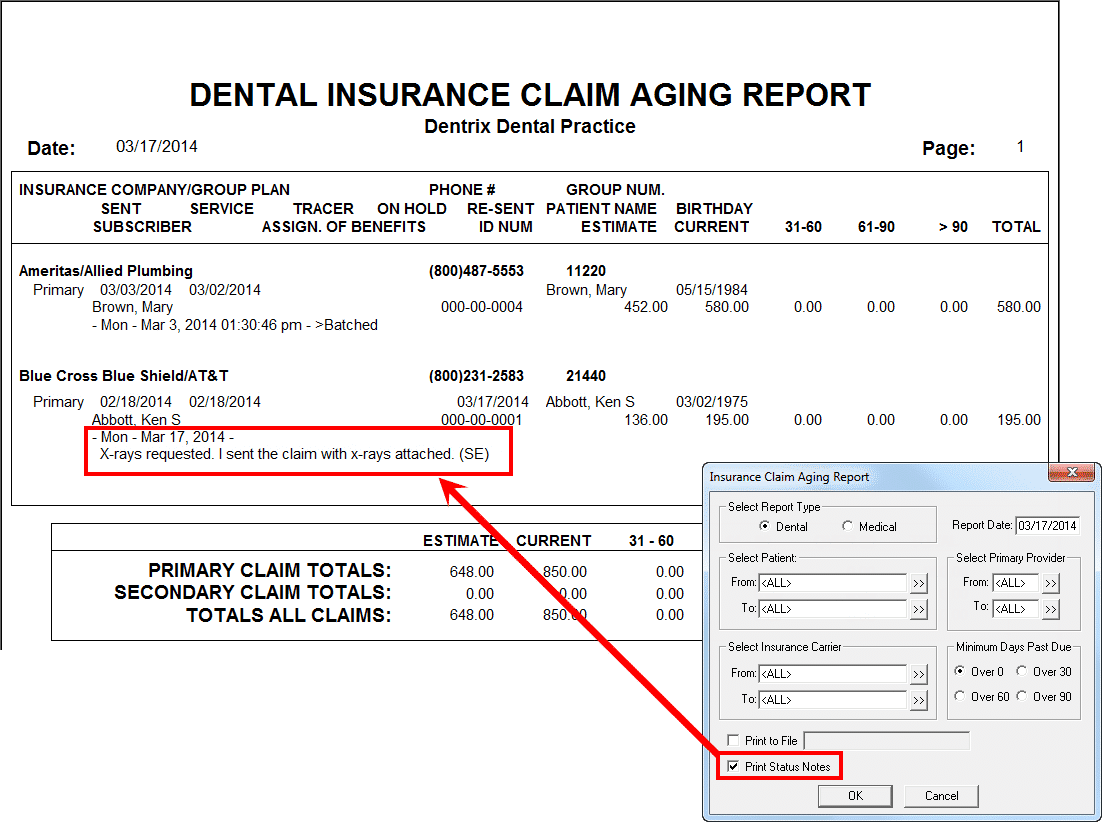

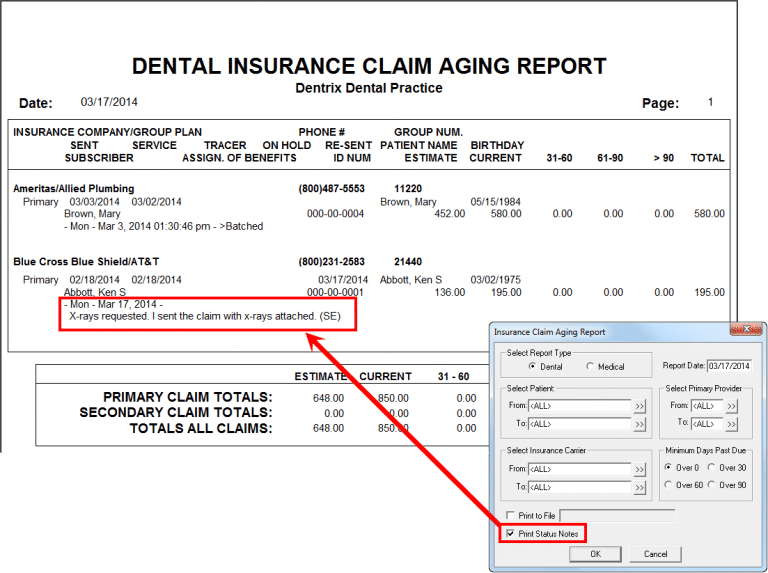

How to Run the Insurance Claims Aging Report in Dentrix

- Go to the Office Manager Tab in Dentrix

- Then go to “Reports” at the top left of the screen in the toolbar area

- Select “Ledger”

- Select “Insurance Aging Report”

- If you are trying to get a baseline

- Select all claims over 0

- If you are trying to work all claims over 30 days

- Select all claims over 30 days

The last page of the report will break each category down into 3 sections:

- 30-59

- 60-89

- 90+

The total amount submitted in the far right column is how much you have outstanding to insurance over 30 days.

Image owned by Dentrix: “Understanding the Insurance Claims Aging Report”

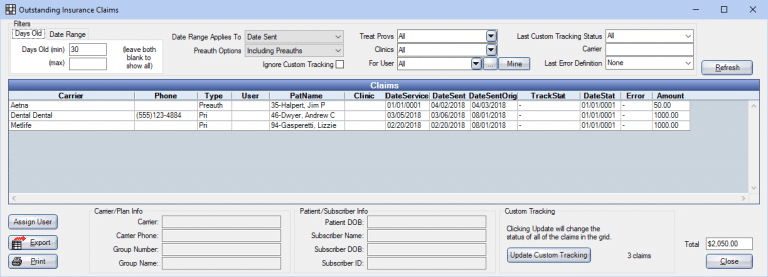

How to Run the Insurance Claims Aging Report in OpenDental

- Go to the “Reports” tab in the top toolbar and click “Standard”

- In the 3rd box (the one at the bottom) select the 5th option “Outstanding Insurance Claims”

- Once the Report pops up, make sure the Minimum Date in the left corner says “30” and the Maximum Date is left blank

- In the middle of the Report box, click on the option that says “Include Pre-Authorizations and Claims”

- Make sure you are only running the report for claims, not pre-authorizations

In the left-hand corner of the Aging Report box, you will see a total number with a Dollar Amount ($) in front. That is how much you currently have outstanding to insurance over 30 days. You can change the number of days in the top right corner of the box to get your number for:

- 0+ (Make the top number 0 and leave the bottom box blank)

- 30-59 (Make the top number 30 and make the bottom box 59)

- 60-89 (Make the top number 60 and make the bottom box 89)

- 90+ (Make the top number 90 and leave the bottom box blank)

Image owned by OpenDental

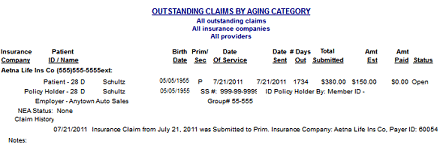

How to Run the Insurance Claims Aging Report in EagleSoft

- Go to the “Reports” tab in the top toolbar in your EagleSoft homepage

- In the Tabs section, select the “Insurance” option which is the third option on the 2nd row

- You can scroll down or simply press the letter “O” to get you to “Outstanding Claims by Aging Category”

- Click Process

- Leave All Insurance Companies and All Providers

- If you wish to get a baseline, leave all boxes checked for “Choose Claims”

- If you wish to solely work on claims over 30, 60, or 90 make sure you have the corresponding boxes checked

The last page will show you how much receivables you have outstanding to insurance for each category. Make sure you are looking at the left-hand number for “Total Submitted” NOT “Total Estimated.”

You will need to add up each Total Submitted Category and that will give you your total outstanding receivables to insurance.

Image owned by Eaglesoft & Patterson Companies, Inc.

How often should I run an outstanding dental insurance aging report?

It is recommended to run the dental insurance aging report weekly to look for any trends or spikes in the outstanding claims. If you keep your numbers recorded from week-to-week you can catch a spike early. If you go months without running this report, it might be too late and some of these claims will fall into the timely filing category mentioned above.

How long does it take to manage an outstanding dental insurance aging report?

This all depends on how many outstanding claims you have and the issues associated with the claims on the report. Another factor to consider is your availability to work the report uninterrupted.

While trying to tend to your other responsibilities within your practice, carving out a chunk of time to call insurance companies may become quite difficult. Insurance companies are notorious for long hold times and dropped calls.

This is where expert RCM companies, like DCS, help you with this task. Having a team of experts dedicated to researching and resolving your outstanding insurance claims can decrease the amount of time it will take to work this report.

Regardless if you handle this at the office level or choose to utilize services like DCS insurance billing, the time required to work through the report completely depends on the amount of time it has been neglected. However, once the report has been given it’s first “deep cleaning,” it should be on somewhat of a maintenance system moving forward.

To continue to educate yourself, find out how to work your outstanding insurance aging report efficiently.

Related Posts

Dental revenue resources from Dental Claim Support