How to Properly Submit a Dental Claim During the Credentialing Process

The challenge occurs most often when a treating provider joins a practice as an associate practitioner. During the credentialing process, practices are often tempted to submit claims using the already credentialed doctor or owner doctor listed as the treating provider. This is inappropriate because that provider may be receiving reimbursement he is not entitled to receive.

A non-credentialed associate treating patients with a PPO plan can create ill will between existing patients. As a practice, you want to continue to provide care at the negotiated rates for these patients while ensuring we are not submitting potentially fraudulent dental claims.

This article will review how to submit legitimate claims and receive appropriate reimbursement while going through this lengthy process. The billing entity and treating provider sections of the 2019 ADA dental claim form will be reviewed to ensure the information entered results in appropriate reimbursement. Additionally, we will learn what an NPI number is and the difference in an NPI type 1 and NPI type 2 number and how it can delay claims processing.

How is the billing entity reflected on the claim?

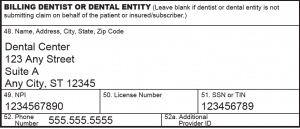

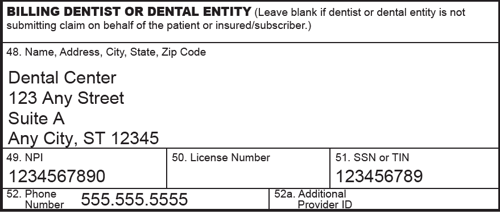

The billing entity or practice name is listed on the bottom left of the 2019 ADA dental claim form, and this indicates to the payer to whom the payment is issued. Basically, the billing entity information is who receives the insurance payment.

This section must include the practice legal name or what name the practice is “doing business as” (DBA). What is also included in this section is the practice EIN (Tax ID) and the practice NPI type 2.

Sorry, but get ready for the alphabet soup! An EIN is an Employer Identification Number obtained via the Internal Revenue Service (IRS). An EIN is similar to a social security number and identifies a business, or in this case, the practice or billing entity for tax purposes.

An NPI is the National Provider Identifier and is part of Health Insurance Portability and Accountability Act (HIPAA) Administrative Simplification Standard. There are two types of NPI numbers: Type 1 and Type 2.

The NPI type 1 identifies the healthcare providers who may be providing treatment or prescribing medication. All healthcare providers, including dentists were required to obtain an NPI type 1 number effective in 2007.

- An NPI Type 2 number identifies the billing entity or practice and all treating providers associated with the practice. Centers for Medicaid and Medicare Services (CMS) issues and maintains NPI numbers.

It is acceptable for a sole proprietorship to use the owner doctor’s NPI type 1 to identify the billing entity.

However, it is advisable for any practice with more than one treatment provider to obtain an NPI type 2 number. The NPI type 2 number identifies the billing entity and all associated treating providers as a whole.

Failure to obtain an NPI type 2 number when there is more than one treating provider can result in payment delays.

For example, many federal plans will hold payment when a new associate is listed as a treating provider and the owner doctor’s NPI type 1 number is used to identify the billing entity. It can be a time consuming task to work with provider relations to obtain the backlog of held payments once the NPI type 2 is obtained.

Be proactive and obtain an NPI type 2 number before it becomes an issue.

Who is listed as the treating provider?

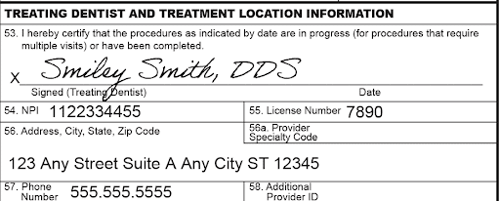

The doctor who provided the treatment listed on the dental claim form or who supervised the hygiene services is listed in Box 53 on the bottom right of the 2019 ADA Dental Claim Form. This would be your treating provider.

Always list the correct treating provider regardless of the in- or out-of-network status with the payer. Failure to accurately list the treating dentist results in a fraudulent claim being submitted. The treating doctor listed on the claim and the billing entity may receive reimbursement in which they are not entitled.

How is the claim paid if the treating dentist listed is not credentialed yet?

This type of claim will be processed as out-of-network. Any available out-of-network benefits of the patient’s plan will be applied to the claim. Note that some plans have no out-of-network benefits.

The out-of-network reimbursement may also be issued to the subscriber of the plan for treatment provided by an out-of-network dentist, regardless of assignment of benefits. Assignment of benefits is essentially who the insurance pays; the dental office or the subscriber/patient.

This can be set up in any dental software. Within your dental software you should be able to indicate who to assign benefits on a per plan basis. In some instances, failure to properly assign benefits to the provider may result in the patient receiving the benefit reimbursement. This creates a collection issue between your dental practice and the patient. On the other hand, it could be that the patient paid the charge in full, and you fail to assign benefits to the patient mistakenly sending the payment to you instead. This can create ill will with your patient. Assignment of benefits laws vary by state. Know your state law to reduce any surprises and patient collection issues.

Can claims be submitted under the previous owner billing information?

So, you just bought a dental practice. Congrats!!

Can you still submit claims under the previous dentist or owner? No.

We are often asked if the buyer can apply the seller’s billing entity and list the previous credentialed owner as the treating doctor on the claim form. This is an inappropriate billing practice as it is misrepresentation.

Once the sale of the practice has taken place, the new name of the practice and billing entity is accurately reflected in Box 48 of the 2019 ADA Dental Claim Form. This is effective for all dates of service on or after the sale of the practice.

For the same reasons already discussed in this article, the previous owner cannot be reflected as the treating dentist on the claim form.

However, what if the previous practice owner is now an associate of the new practice and actually performed or supervised the services listed on the claim? In this case, the previous owner now associate, will need to be recredentialed to connect her with the new billing entity.

Do PPO payers allow special provisions for claim submission during the credentialing process?

You may contact each PPO payer in which you are credentialing to ask if there is a provision for submission during the credentialing process. Refer to your PPO contract and Provider Processing Policy manual/Dentist Handbook or contact the PPO provider relations department to inquire about such provisions.

How can we avoid these challenges?

Credentialing can be a daunting task and one that requires patience throughout the process. Begin the credentialing process as soon as possible to avoid any reimbursement delays. Understand and implement proper claim submission during the credentialing process to ensure you are receiving appropriate reimbursement.

Credentialing can be accomplished by your in-house dental team or by contracting with a credentialing specialist. Consider all options to make the credentialing process as smooth as possible.

Related Posts

Dental billing resources