7 steps of revenue cycle management: A step-by-step guide for your dental team

What’s the key to a healthy and profitable revenue cycle in dentistry?

You guessed it: Revenue cycle management (RCM). A well-managed revenue cycle reduces the time it takes to collect payment, from the moment patients schedule a visit, to the final insurance or patient payment.

But what are the steps in between to get you paid? When your goal is to receive revenue faster, but you have billing, coding and staffing challenges, the value of RCM becomes clear. Here are the 7 steps of revenue cycle management, each building on the previous one.

Welcome to the 7 steps of revenue cycle management.

These are the 7 essential steps of revenue cycle management that enable you to create an excellent patient experience, while you scale and maintain financial health.

Each step of revenue cycle management needs to be completed efficiently and accurately for the entire process–and your dental business–to run well.

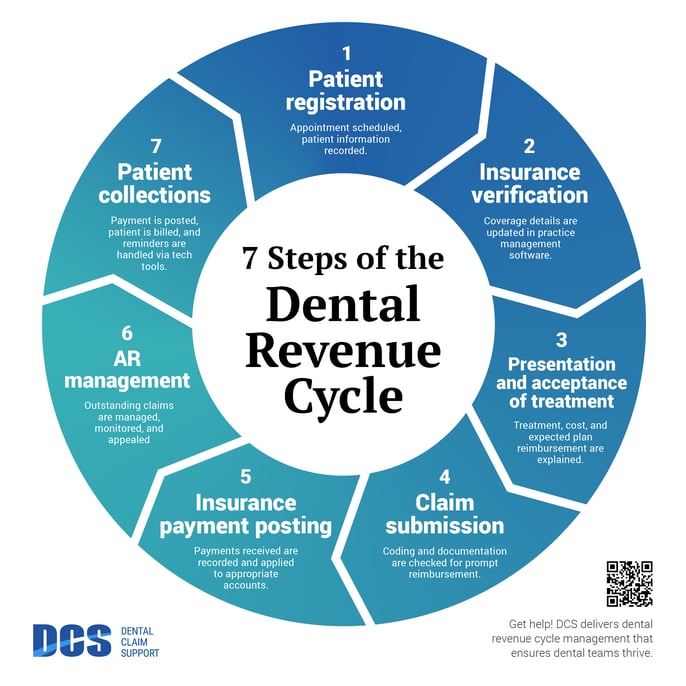

This revenue cycle management flow chart helps to visualize what happens at each step, and the overall impact on the financial health of the dental business.

This article will define all 7 steps in this revenue cycle management flow chart so that you will create your best RCM strategy and improve the financial health of your practice or group.

Step 1. Patient registration

Revenue cycle management begins when the patient requests an appointment. The team captures their personal and insurance information for registration and insurance verification.

Your in-house team is responsible for accurately recording and documenting patient details. To be most cost-effective, accuracy is key. It’s important at this stage to double-check spelling and numbers — it’s easy to make errors with manual data entry, or when dealing with a growing number of patients and their data.

Patient registration sets the stage for how smoothly the rest of your RCM process will go.

Errors or missing information during patient registration will increase the number of denied claims, inaccurate patient statements, and operating costs for a practice or group.

Step 2. Insurance verification

Dental insurance verification ensures that the provider has current details about which services are covered by the patient’s plan. Then, the team ensures that the patient understands their financial responsibility for services — and the insurance policy — before treatment is completed.

The team gathers and records the patient’s data, then compares it with what their insurance provider has on file.

To improve revenue at this stage, more teams are working with an insurance verification partner with the technology to support a faster, more accurate process. RCM experts such as DCS use the latest technology to verify and update your patient records prior to the patient’s appointment.

This enables your team to prepare cost estimates and treatment plans, with a full-breakdown of the patient’s benefits already on record.

With effective insurance verification, you’re able to continue to the next step with ease: treatment plan presentation.

Step 3. Presentation and acceptance of treatment

The provider presents the treatment plan to the patient, including the cost and expected insurance reimbursement for their treatment. The patient’s estimated financial responsibility and payment options are explained.

This is a good time to go over your payment policies, what kind of financing options you offer, and timing for when certain treatments should take place.

Transparency is key during your treatment presentation. Make sure your patients understand your expectations, and you can answer their questions easily. This makes acceptance of treatment more likely.

Step 4. Claim submission

Coding and documentation are the most important steps in submitting clean claims. Accurate coding and complete documentation ensures that claims are processed correctly and reimbursed appropriately and promptly.

Ask any dental professional, and they’ll tell you how submitting claims that are reimbursed the first time has become more and more challenging.

Insurance revenue is a particular part of your revenue cycle management process that sees the greatest improvement with RCM experts supporting your team.

RCM experts specialize in knowing what it takes to get faster payments, overturn denials, and minimize costs.

Codes, rules, and policies change frequently. Without dedicated experts to keep the process updated and compliant, thousands (or millions) of dollars remain uncollected.

Related: 4 signs your dental team doesn't have time for insurance claims

Expert RCM services minimize costly errors, re-work, and the number of A/R days.

Step 5. Insurance payment posting

This step ensures that all financial records for patient services are correct, and payments match the expected amount. Accurate payment posting is crucial to reduce the risk of revenue loss due to payment processing errors, late payments, or denials.

It also deters embezzlement. If there are any discrepancies or irregular adjustments, RCM experts must investigate and address them. Because of their extensive experience, partnering with RCM experts is highly effective in reducing the risk of embezzlement.

Related: How can embezzlement be prevented at your dental business? 3 ways RCM will help protect you

Step 6. AR management

AR management is the process of pursuing unpaid claims until they are resolved. It includes monitoring and managing outstanding claims to ensure that they are reworked, resolved, and denials appealed until they are paid and posted.

AR management holds the insurance companies accountable to honor the terms of your contract.

When A/R is managed at a high level, you’ll see fewer write-offs and improved cash flow. This is because there is no money left on the table (or in the hands of insurance companies). An expert is working to appeal denials, and follow up with unpaid insurance claims to ensure you’re paid what you’re owed.

A/R management will also:

- Ensure timely revenue collection

- Reduce bad debt

- Improve compliance with regulations

- Improve patient satisfaction with a process that makes best use of their benefits

RCM experts will know the best practices and strategies for appealing denials and communicating with insurance companies until your claims are paid.

Step 7. Patient collections

The patient is billed for the balance once insurance payments are posted. Collecting the patient balance includes sending reminders via tech-enabled tools.

The easier it is for your patient to pay you, the better. When you automate patient billing, you see increased patient revenue. You’ll also save on the overhead costs of mailing paper bills. And of course, nothing is quicker to annoy your patient than complicated billing. Automating your patient billing system makes it easier for your patients to pay, and for you to collect.

At DCS, automated patient billing is a core component of RCM services. Using AI-assisted technology, we ensure your patients receive timely, automatic reminders of what their balance is and when it is due.

Using RCM services to streamline your patient billing reduces your administrative costs by eliminating time-consuming workflows and follow-up calls.

How will expert RCM support improve your dental business revenue?

You now know all 7 steps of revenue cycle management for dental practice and groups.

By understanding each step of your revenue cycle management, you’re able to evaluate how efficient each step is in your own dental business.

Partnering with RCM experts will not only improve the efficiency of your revenue cycle, but also transform your profitability.

Working with an end-to-end RCM company like DCS will streamline revenue collection for your practice or group. A growing dental business needs support to provide great patient care and attract doctors and clinical staff. And best of all, your revenue will be maximized.

Schedule a call to talk with an RCM expert at DCS.

Related Posts

Dental revenue resources from Dental Claim Support